November 5, 2025

Metro Vancouver Office Figures Q3 2025

-SCM-202304-bx2f8.jpg)

Market Highlights

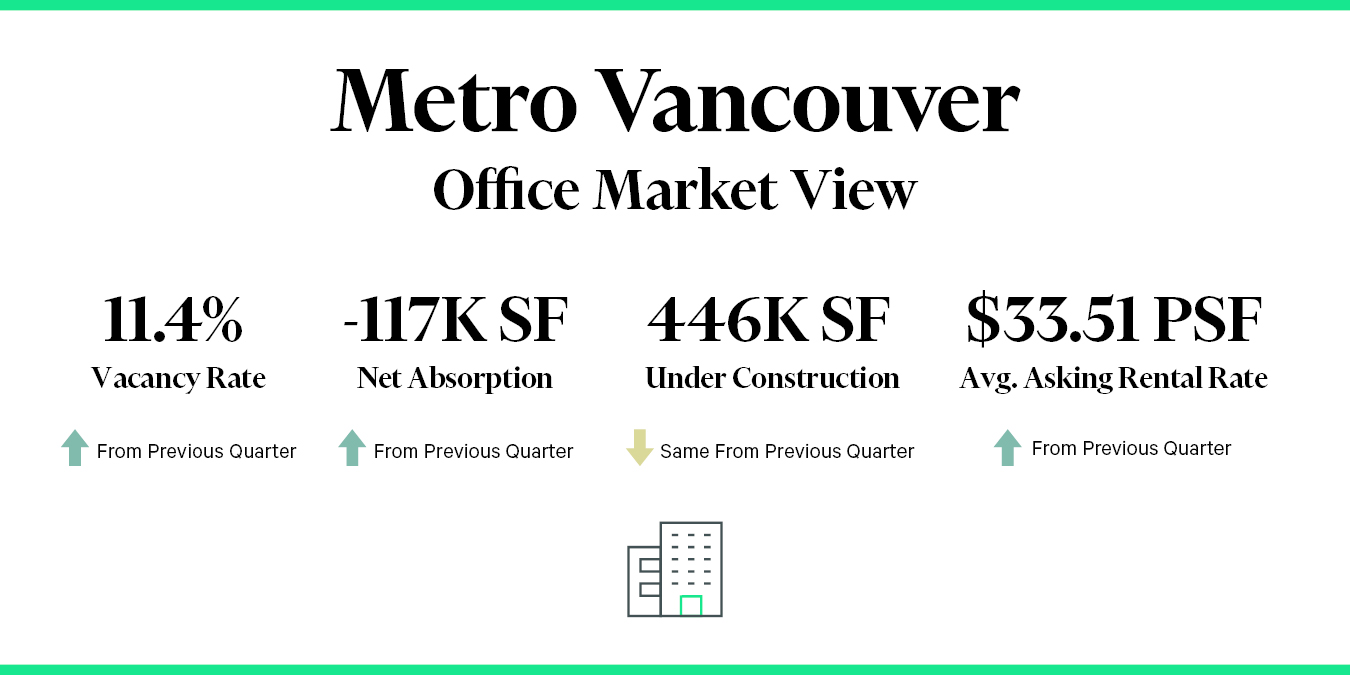

- Vacancy Rate: The Metro Vancouver office market experienced an increase in vacancy, rising 50 basis points (bps) to 11.4%. The Downtown vacancy rate rose to 12.6%, a 70 basis point (bps) increase quarter-over-quarter, reaching its highest level in over 21 years.

- Net Absorption: Metro Vancouver saw a net absorption of -117,025 sq. ft. during the quarter, indicating more space was added to the market than absorbed.

- Class Trends: Downtown Class B & C space experienced the largest vacancy increases, with Class B reaching 19.1% and Class C at 14.3%. Class A vacancy decreased due to the 725 Granville Street Lululemon lease.

- Gross Lease Activity: Total gross leasing activity in Metro Vancouver was 1.1 million sq. ft., slightly below Q2 but still above the five-year average. Downtown accounted for 68.0% of this volume, with healthy activity in the Class AAA & A buildings.

- Rental Rates: The average asking rent for office space in Metro Vancouver is $33.51 PSF while Downtown net asking rents remained stable at $36.50 PSF.

- Under Construction: Approximately 446,000 sq. ft. of office space is currently under construction across Metro Vancouver.

Download Report

Insights you might also like...